Renewable electricity production has been growing significantly over the past decade, and now represents about 30 percent of global electricity supply1 and a market of US$1 trillion2. Renewable Energy Certificates (RECs) play an important role in the growth of this market, capturing the social and environmental benefits of this type of electricity generation. These certificates are then traded between organizations to help meet internal or external carbon emission targets.

Beacon Platform has enhanced its energy trading and risk management (ETRM) functionality to make it easier for energy producers, traders, and consumers to price, trade, and manage the risk and operational workflows associated with renewable energy trading. While this example is focused on RECs, Beacon supports multiple different types of energy attribution certificates (EACs) and we routinely work with clients to extend our functionality and encompass different market conventions.

What’s a REC?

Each REC typically represents 1 Megawatt hour (MWh)3 of electricity generated from renewable sources and is an accepted legal and financial instrument for accounting, tracking, and trading ownership of emissions credits. Energy providers are awarded these certificates by delivering electricity to the grid from renewable sources. Excess certificates can then be traded to other organizations to help meet their own emission requirements. Producers, load serving entities, and trading companies who cannot meet their obligations for green energy production can buy these certificates to satisfy the net obligations.

What makes trading RECs different?

Trading REC’s carries many of the same operational characteristics as trading physical commodities like oil, natural gas, or wheat. These characteristics, such as delivery location, delivery uncertainty, producer, class requirements, and counterparty, can change throughout the full life cycle of a trade, from the initial state of an unscheduled obligation through scheduling and realization of delivery. Prices and risk assessments need to incorporate any realized events during the operational process. Risk and modeling choices can also impact the projected operational and financial exposure, giving traders and risk managers the incentive to actively monitor and optimize the procurement and the net obligations’ fulfillment.

Companies can also leverage the fungibility of RECs to maximize their profitability or optimize their risk; for example surrendering certificates with different vintages, standards, or certifications to satisfy suitable obligations. Trading and risk management systems that are not designed to incorporate real world updates often yield awkward adjustments and workarounds that make it difficult to maintain both a complete picture of the organization’s current exposure and full transparency into the history of the life of a contract.

Managing emissions exposure on Beacon Platform

Working with energy trading companies, we developed and deployed a data model and product extensions to handle the physical elements of commodities and nuances of renewables trading, connecting these complex transactions to the risk and pricing engines of Beacon. These changes are enabling energy traders to annotate their trades, apply new information, and track the progression of each contract over time, without losing the original values. As commitments are realized and expectations of the residual commitments change, the trade dynamically reflects the best available information through time-aware machinery.

We extended Beacon’s use of a bi-temporal data model that includes both “as-of” and “entry” times to allow multiple data entries for transactions that correspond to real world events. By design, this new data does not trigger contractual amendments since they do not modify the contractual terms. However, they can still affect market values and risks, and ultimately impact P&L of the book. As a result, when applied to REC trading, Beacon provides a comprehensive representation of REC transactions that spawn off either obligations or inventory, and feeds those into a consolidated system that allows you to manage and plan future exposure.

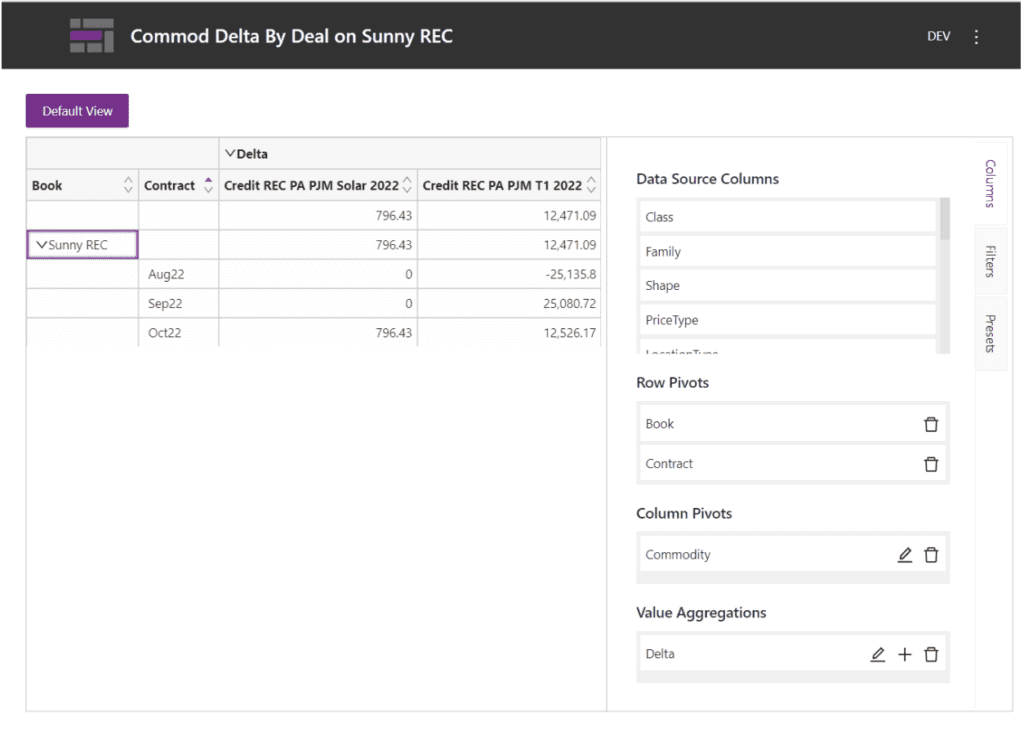

Position reporting example using Beacon’s Virtualized Pivot Table

Visibility, flexibility, and integration

Beacon Platform provides energy companies of all types with powerful capabilities to improve their trading and risk management operations. Instead of relying on a black box with fixed functionality, Beacon’s transparent source code license gives clients full visibility of all models and algorithms and the flexibility to modify them or use their own proprietary code. This enables clients to overlay their emissions trading workflow natively into the system so that planning, optimization, and risk management do not require an off-system extension, typically in one or more spreadsheets. Other Beacon clients have adapted the REC extensions to cover Community Choice Aggregations (CCAs), another form of renewable energy procurement. A broad range of data and programming interfaces makes it easy to interoperate or integrate with other systems, leveraging the best qualities from each.

Contact us for more information, or to request a demo of these and other features of Beacon’s all-in-one platform.

Footnotes

- 2022, IEA, Renewable Electricity Tracking Report

- 2023, Statista, Renewable energy market size worldwide in 2021

- 2023, U.S EPA, Renewable Energy Certificates