Portfolio managers need to continuously assess the risks of their positions and proposed trades, whether for regulatory reasons or internal risk and operating constraints. This becomes challenging when using siloed trading and risk management systems that provide delayed snapshots of what the risk were at some point in the past.

Let’s take a look at this from the perspective of SEC Rule 18f-4. Under this rule, registered investment firms in the US are required to calculate Value-at-Risk (VaR) and Expected Shortfall (ES)-based limits for derivatives exposure that exceeds 10% of the portfolio’s net assets. VaR must not exceed 20% of the fund’s net assets if Absolute VaR is calculated, or 200% of the VaR of a reference benchmark if the Relative VaR is calculated. If the portfolio exceeds these limits, they may be required to unwind the positions within a set period, with unpredictable consequences.

Integrating VaR into the trading process

If portfolio managers know how close they are to the VaR limit or what impact a proposed trade will have, they can more effectively manage the portfolio risks, avoid or modify positions that will exceed risk levels, and be ready to capture emerging opportunities. Beacon’s unified framework for pre-trade analysis, trading, and post-trade risk assessment enables portfolio managers to assess risk intraday, before adding to or modifying their portfolio.

With Beacon Trade Blotter and Risk Reporting Tools, portfolio managers can maintain books and portfolios across all asset classes, and run risk reports when needed, not just at the end of day. For the example below, we consider a cross-asset book containing IR swaps, swaptions, caps, bonds, equity options, and FX options.

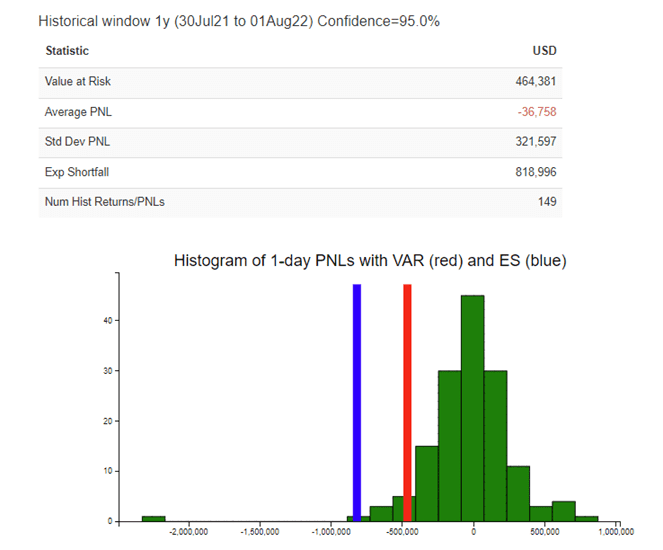

Figure 1: Beacon value-at-risk and expected shortfall report over one year for the selected book. In this example there is a 5% probability of a loss of more than $464,381 (VaR) over one day and the ES is at $818,996.

Figure 1: Beacon value-at-risk and expected shortfall report over one year for the selected book. In this example there is a 5% probability of a loss of more than $464,381 (VaR) over one day and the ES is at $818,996.

When preparing for a new trade, Beacon Quote is used to price and structure trading strategies, plot the risk payoff, solve for specific outcomes, and quickly visualize intraday spots, forward curves, yield curves, volatility surfaces, and other valuable analytics.

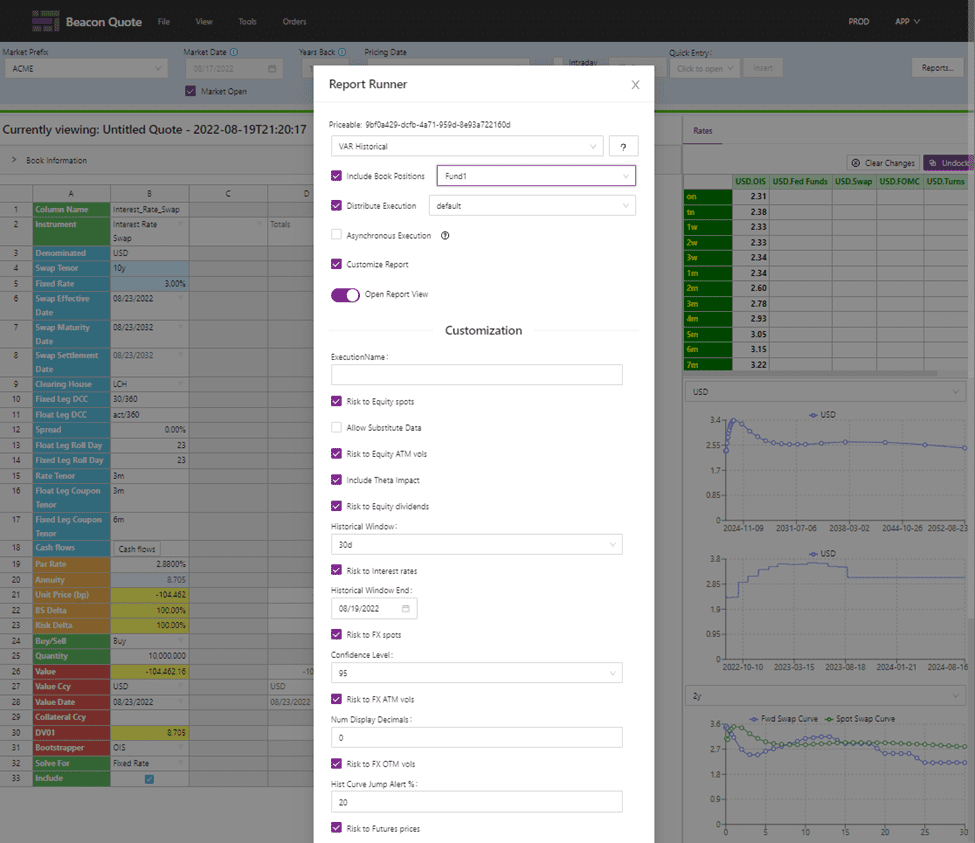

Figure 2: Beacon Quote and Report Runner dialog box, showing options for running VaR report before booking a trade

Figure 2: Beacon Quote and Report Runner dialog box, showing options for running VaR report before booking a trade

With these tools, a portfolio manager can now easily assess the impact on VaR and ES from adding this new swap instrument into the book, before executing the trade.

Leveraging cloud computing capabilities

VaR calculations can be very compute-intensive depending on the size and complexity of the book and the period over which it is calculated. Beacon’s cloud-based platform enables users to run the calculation on an elastic compute grid and use additional compute engines as needed for the desired response time. Portfolio managers can also schedule automatic processes to run risk reports multiple times a day, for live insights on a portfolio’s risk profile, which can be particularly useful during periods of market volatility.

To execute the trade, portfolio managers can use Beacon’s Workflow Management module, which provides the ability to track, orchestrate, and automate trade execution. For risk analysis on a pre-trade basis, a workflow can be set up so an instrument can be executed or booked only if the VaR or ES of a particular book does not exceed the specified limits, or to flag trades that will exceed risk limits, providing early warning to adjust positions or post more capital.

Extending these capabilities into existing systems

Beacon’s integrated development environment and transparent source code license enable customers to easily integrate these tools with existing systems and data, and modify the code to meet their specific needs. Instead of using Beacon’s applications, analytics and reports can be run programmatically via an API and ingest data or deliver results to other applications, including Jupyter Notebooks, or spreadsheets via Beacon’s Excel Evaluator. Whether you use Beacon’s out-of-the-box VaR model, customize it, or call your own risk analytics libraries, the same results are generated in every instance, from Beacon applications or via the API, providing much-needed consistency.