By Brian Wood, Senior Product Manager

Hedge funds, banks, and tech-driven trading firms are looking to grab a greater share of the profits available in energy and commodities markets. A significant majority of traders (66%) expect the number of new market entrants to increase by up to 50% over the next 24 months, and 32% predict that it could rise by more than 50%.

To examine the actions and motivations of these market participants, we commissioned a research study of energy and commodity traders in North America and Europe, whose firms collectively manage tradable assets of $1.4 trillion.

With nearly all traders anticipating a substantial influx of new competition, the race for alpha is intensifying across the sector.

Going for the gold

Most of the existing market players are definitely after the money. When asked about the strategic focus of their trading, two in three (65%) respondents indicated they had a stronger emphasis on profits over hedging. Only 5% said their focus was primarily on hedging risk, while 21% said they took a balanced approach between the two.

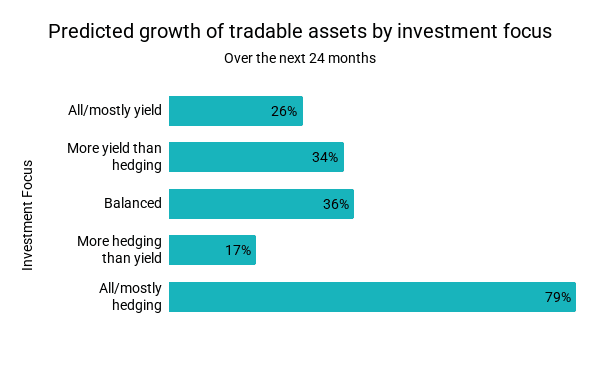

Interestingly, hedging-focused respondents expect two to three times more capital growth over the next 24 months than balanced or profit-focused respondents.

Outsourcing is the top choice for improving risk management

To understand how these traders are managing increasing risks and volatility, we asked about their intended steps for improvement. We found that outsourcing risk management to third-parties is the key strategy firms are adopting to improve risk management capabilities.

Outsourcing to specialized firms ranked first on a list of seven strategies, followed by adding new tools or platforms to plug gaps in current systems, and transferring risk management analysis away from spreadsheets and manual processes. Hiring additional risk management staff ranked fourth, with changing existing platforms, expanding recruitment across sectors, and increasing training rounding out the list.

Execs and analysts have a different perspective

Comparing the responses from the executives and their quant, trader, and analyst colleagues paints a slightly different story. Executives placed the most emphasis on outsourcing, while their trader and analyst colleagues placed an even greater emphasis on getting risk management analytics out of spreadsheets.

Technology can be a competitive advantage

As the competition increases for new capital flowing into this market, firms face mounting pressure for optimized risk exposure, enhanced transparency, and sophisticated pricing models. Moving from spreadsheets to modern analytics and real-time risk management solutions will be critical to attract and retain both clients and talent.

About This Research

Beacon Platform, a Clearwater Analytics company, Inc. commissioned independent research company Pure Profile to interview 100 senior energy and commodity traders at specialist trading firms, hedge funds, fund managers and investment banks responsible for total capital allocated or assets under management for trading of $1.4 trillion. Respondents were based in the US, UK, Europe and Canada. The research was conducted during March 2025 using an online methodology.