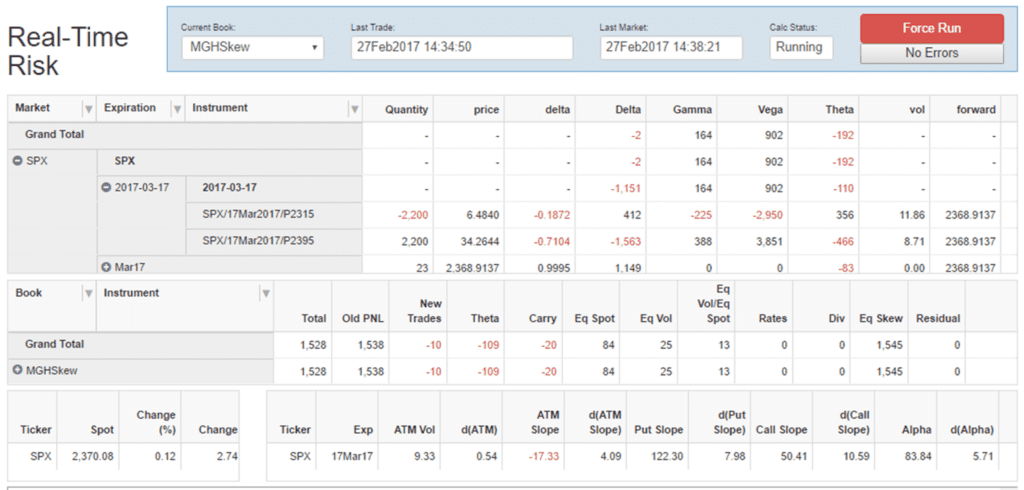

Volatile markets and cross-asset strategies have created a risk management environment that demands more complex models and faster responses. Our unified platform enables financial services firms to gain broad visibility of all forms of risk, across all asset classes, and distill it into actionable insights.